An analysis of Palantir and Amazon's trajectories in the AI industry, highlighting why Amazon is considered the superior tech stock to buy.

Palantir: Pioneering AI-Driven Data Analysis

Palantir, founded by venture capitalist Peter Thiel in 2003, is a pioneering data analysis firm that leverages advanced AI-driven software and data analytics. The company's AI platforms eliminate the need for coding scripts or statistical models, allowing users to interact with the system using natural language. Palantir's services have gained widespread acceptance across various sectors and customers, including the recent acceptance of its bid for the development of the TITAN program by the US Army.

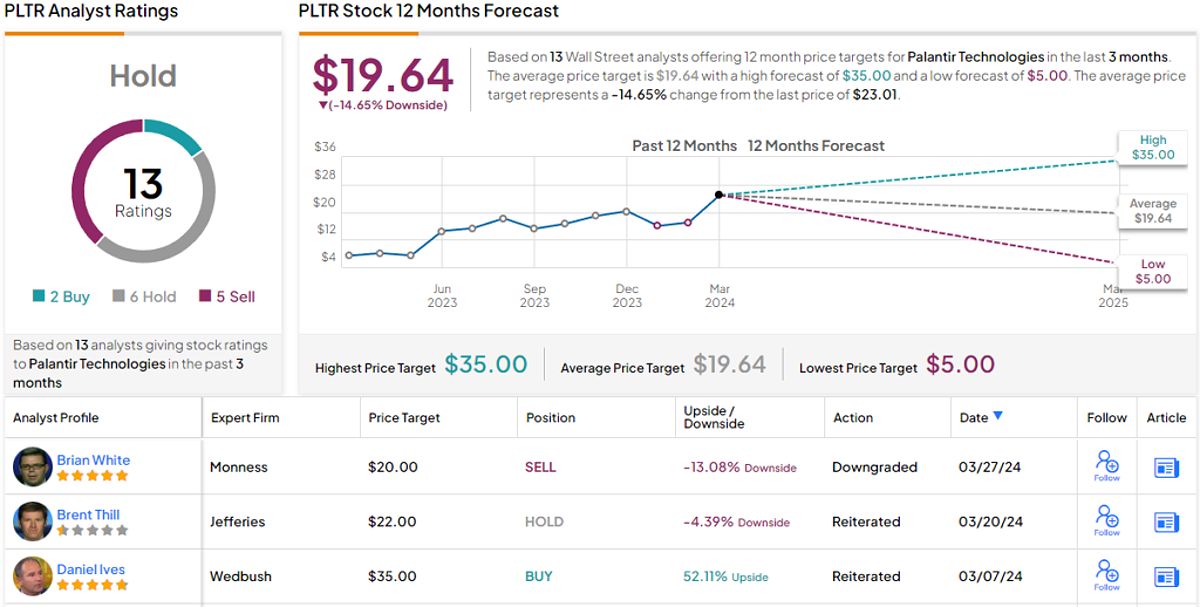

Despite its success, top-rated analyst Brian White views Palantir as overvalued. He cites concerns about revenue volatility from government contracts and an excessive valuation, which raises questions about the company's long-term prospects.

Amazon: Dominating E-Commerce with AI Innovations

As the world's largest online retailer, Amazon dominates the e-commerce industry with its massive market cap of $1.87 trillion. The company's revenue primarily comes from its e-commerce activities, generating approximately $1.4 billion daily. Amazon's vast network of fulfillment centers enables rapid order fulfillment and quick deliveries worldwide.

In addition to its e-commerce prowess, Amazon offers a range of subscription services, including the popular AWS cloud computing service. The company has also recently increased its investment in the AI startup Anthropic, signaling its commitment to AI development and innovation.

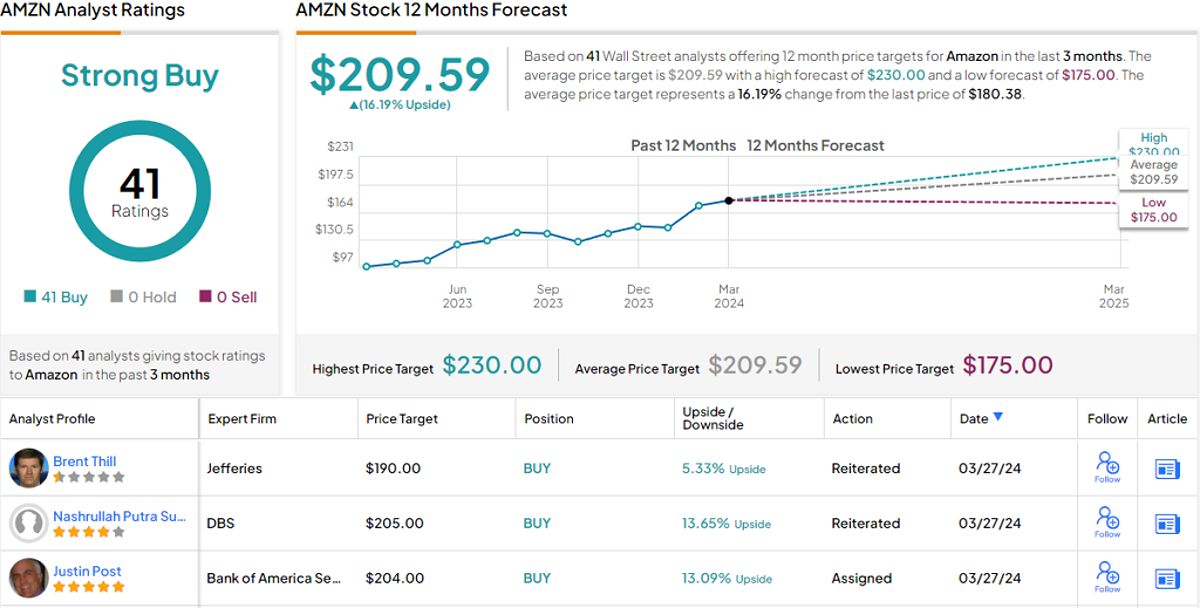

Brian White believes that Amazon's strong presence in the cloud service market and its ability to innovate with AI will contribute to its continued success in the evolving tech landscape.

Financial Performance: Palantir vs. Amazon

In Q4 2023, Palantir reported impressive financial results with a top line of $608.35 million and GAAP profitability for the fifth consecutive quarter. However, despite its positive performance, Brian White questions the valuation of Palantir's stock, which has surged in recent years.

On the other hand, Amazon's Q4 2023 revenue reached $170 billion, representing a 14% YoY increase. The company's AWS subscription cloud service experienced a 13% YoY growth, contributing significantly to its overall revenue.

Analyst Recommendations: Palantir and Amazon

Considering the perceived overvaluation of Palantir, Brian White has downgraded the stock to a Sell rating. He sets a price target of $20, implying a potential downside of 13%. In contrast, White maintains a Buy rating on Amazon, with a price target of $215, indicating a potential upside of 19%.

The overall consensus among analysts is also bullish on Amazon, with a Strong Buy rating based on 41 recent analyst reviews. The combination of Amazon's diverse range of services, dominance in the e-commerce industry, and investments in AI and cloud computing positions the company for continued success, according to Brian White.

Conclusion: Amazon's Superiority in the AI Revolution

While both Palantir and Amazon are prominent players in the AI revolution, Brian White believes that Amazon has the edge. Despite Palantir's potential to benefit from the long-term AI trend, concerns about revenue volatility, execution challenges, and an excessive valuation raise doubts about its future performance.

In contrast, Amazon's dominance in the e-commerce industry, strong presence in the cloud service market, and investments in AI and innovation position the company for continued success. Investors should conduct their own analysis and consider these factors before making any investment decisions.