Major financial firms are investing billions of dollars in capital-intensive climate infrastructure projects, signaling a renewed confidence in the potential of the climate tech industry. This financial support, coupled with government initiatives, is expected to drive significant growth and create meaningful environmental impacts.

Wall Street's Big Bet on Climate Tech Signals Renewed Confidence in the Industry

Last week, Graphyte, a startup specializing in carbon removal, commenced operations at what could potentially become the world's largest carbon removal facility. This achievement was made possible through significant investments from Breakthrough Energy Ventures, an investment firm founded by philanthropist Bill Gates. Graphyte's success story is expected to be replicated as a wave of financial support for climate technologies sweeps across the country. With Wall Street and Washington gearing up to invest unprecedented amounts of money in climate infrastructure projects, startups in the clean tech industry may finally be able to overcome the challenges that plagued many of their predecessors.

Graphyte CEO Barclay Rogers emphasizes the need for capital sources beyond venture capital to support the construction of large-scale projects aimed at achieving climate goals. In the past, underfunded clean tech companies faced a funding gap, commonly referred to as the "valley of death," which hindered their progress. However, the current confluence of capital from investors and policymakers, who have learned from the mistakes of the past, provides a more favorable environment for climate tech startups. Government incentives and private funds are now available to fill the funding gap and support these companies.

Building Capital Sources Beyond Venture Capital

Graphyte CEO Barclay Rogers emphasizes the need for capital sources beyond venture capital to support the construction of large-scale projects aimed at achieving climate goals. In the past, underfunded clean tech companies faced a funding gap, commonly referred to as the "valley of death," which hindered their progress. However, the current confluence of capital from investors and policymakers, who have learned from the mistakes of the past, provides a more favorable environment for climate tech startups. Government incentives and private funds are now available to fill the funding gap and support these companies.

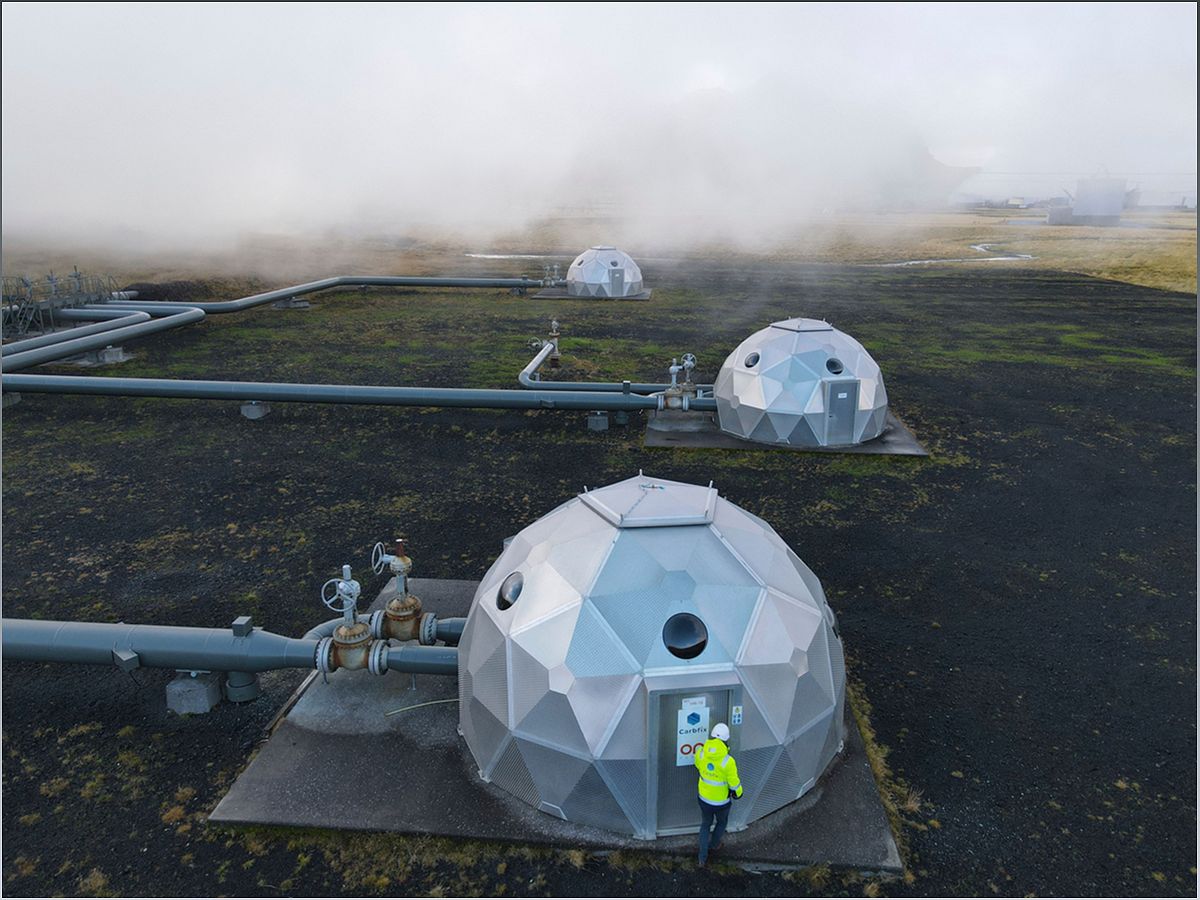

Several major financial firms, including Brookfield Asset Management, BlackRock, Macquarie, General Atlantic, and KKR, have recently pledged to invest billions of dollars in capital-intensive climate infrastructure projects. These projects aim to transition the global economy away from fossil fuels and mitigate the effects of climate change. Brookfield's $10 billion fund, led by Mark Carney, the United Nations' special envoy on climate action and finance, aims to deliver both financial returns for investors and environmental benefits. BlackRock, the world's largest institutional investor, is also actively seeking investment opportunities in climate tech, such as its $550 million investment in Stratos, a direct air capture facility in West Texas.

Reviving the Climate Tech Industry

The injection of funds into climate tech projects is a much-needed boost for an industry that has seen a decline in overall investment since 2021. Offshore wind installations, battery storage manufacturing plants, and hydrogen production facilities require substantial financial backing and a willingness to take risks. The private equity giant Apollo recognized the need to support climate tech firms and established a fund to address the capital gap. Now, with the renewed interest from Wall Street's big players, the industry's fortunes are expected to turn around. Analysts and competing institutions are confident that macroeconomic trends and recent policy changes will prevent a repeat of the clean tech bubble era.

The Role of Government and Wall Street Collaboration

The Biden administration's implementation of climate technology subsidy programs, along with Washington officials actively seeking investment from financial institutions, demonstrates a collaborative effort between government and Wall Street to promote climate tech startups. These initiatives aim to attract private capital to support the development of climate infrastructure projects. With a surplus of capital and increasing momentum, the climate tech industry is set to witness significant growth and create meaningful environmental impacts.

Conclusion

Wall Street's newfound interest in climate tech projects signals a renewed confidence in the industry's potential. As major financial institutions commit billions of dollars to capital-intensive climate infrastructure projects, startups in the clean tech sector have an opportunity to overcome the funding challenges that hindered their predecessors. With government support, private capital, and a growing demand for climate solutions, the future looks promising for the climate tech industry, paving the way for a sustainable and greener future.